Ideally, I’d prefer not to describe what I do and don’t do because infrastructure is complex, dynamic and (in my view) calls for an open-minded and flexible approach. Many of the challenges I’ve helped with have been unique.

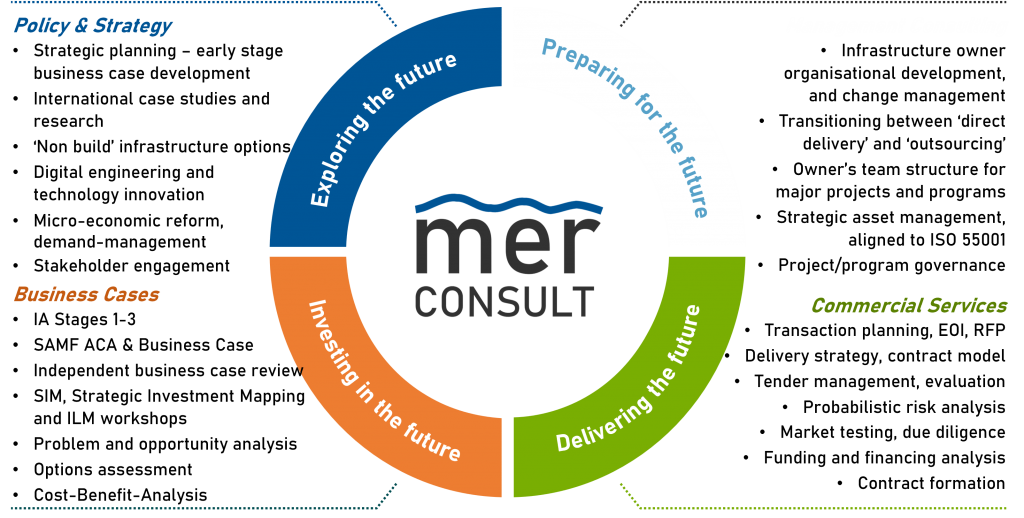

However, I have below listed some topics under four key themes that align with what I think is needed for infrastructure organisations to be successful, and that align with my experience as an infrastructure professional for the last 20+ years.

This is what I am passionate about, what I care about and how I think I can help people and organisations within the infrastructure community. But it’s all about flexibility – so please give me a call if there is something missing!

Strategy and policy advice – exploring the future

- International case studies and research leveraging 20+ years diverse experience and networks in UK, USA and Australia, e.g. recent topics I’ve explored include the future of mobility and program delivery strategies

- ‘Non build’ infrastructure option identification and assessment, such as regulatory and governance reform

- Maximising the use of existing assets through digital engineering and technology innovation

- Micro-economic reform, demand-management, pricing

Management consulting – preparing for the future

- Infrastructure asset owner organisational development, improvement and change management

- Transition from ‘direct delivery’ to ‘outsourcing’ and vice versa

- Owner’s team structure for major projects and programs

- Organisational capability development in specialist areas 1

- Strategic asset management, alignment with ISO 55000

- Project and program governance across the investment planning process

Business cases – investing in the future

- Strategic Investment Mapping (SIM) – business case ‘narrative’ workshops to explore and seek alignment between strategic objectives, problems, opportunities, and options (this is my own bespoke version of ‘Investment Logic Mapping 2 – see http://www.merconsult.com.au/thoughts for more details) – I can also do a more traditional ILM if preferred

- Detailed analysis of ‘base case’ problems and opportunities

- Options identification and assessment using a range of techniques

- Rapid and full Cost-Benefit-Analysis 3

- Stakeholder consultation, deliverability (see commercial services below) and benefits management planning

Commercial services – delivering the future

- Project and program delivery strategy, procurement options analysis, risk allocation and contract models

- Transaction planning, management, documentation (EOI, RFP, etc.), tender evaluation

- Market testing, briefings, due diligence

- Risk workshops, probabilistic quantified risk analysis (QRA), risk management

- Funding and financing analysis, financial modelling 4

- Contract formation in specialist areas 5

Footnotes

- Business case development training – I’ve done quite a few, and I’m happy to share what I’ve learned

- Victoria State Government, Department of Treasury and Finance https://www.dtf.vic.gov.au/infrastructure-investment/investment-management-standard

- I have undertaken and managed several detailed economic analyses but, depending on the sector, I would most likely engage a trusted partner to deliver this service

- I have experience in financial modelling but I would most likely engage a trusted partner to deliver this service

- I have extensive experience in highway maintenance and works contract models and technical requirements – there are many ways to cut this particular cake and I would be happy to help